I’ve been always meaning to read “Digital Gold” to understand the history and origins of Bitcoin. Now that I found time to do so, I thought I’d share the findings, and save you time in this quest for the information of who is who in the exciting, controversial, and often turbulent world of the cryptoverse.

Worth noting Alan Greenspan speech in 1996, where he voiced his belief that money should potentially be created not by the Federal Reserve, but some private entity, which would not be controlled by the government. These words from the former chairman of the Federal Reserve resonated strongly with the growing community of the Cyberpunks, who were looking for ways to disentangle themselves from the government control.

Just as most innovations, the idea of cryptocurrency is coming from the world of sci fi, with Neil Stephenson pioneering the ideas of anonymous Internet banking using electronic money and (later) digital gold currency, in his 1999 masterpiece “Cryptonomicon”. This novel became legendary in hacker circles and promoted an idea of absolute financial anonymity.

The modern understanding of crypto and Bitcoin didn’t spear until the famous Satoshi Nakamoto 2008 whitepaper. Numerous other interpretations and ideas, however, were floating around in late 90s.

In 1997 a British researcher called Adam Back released on the Cyberpunk mailing list his plan for something he called hashcash, which endeavoured to solve the problem of digital replication of money. Around the same time, Nick Szabo created a concept, called bit gold, and involved Hal Finney in his Cyberpunk discussions. Another idea came from an American named Wei Dai, who has created the concept of b-money, which has pioneered the idea of POW.

Clearly, the brainstorming for the digital currency has been under way for around a decade when Adam Back had received Satoshi’s email on Bitcoin.

Till this day no one has definitive proof on the identity and whereabouts of Satoshi, however, it is safe to assume he must have emerged from one of the first ideologists of digital money within Cryptopunk community. Since Bitcoin protocol has been created in a decentralised fashion, the identity of the creator does not really matter that much anymore. The idea has been born, managed to harness a major following and is clearly going to outlive its creator.

The biggest appeal of Bitcoin and the Blockchain protocol is its design as an unhackable trustless decentralised system, where no single person or organisation really has control or say over its development. It is a system without a single point of failure, which is destined to grow and amplify itself through the network effect.

Thus, the only real danger to Bitcoin is the abandonment of the community. This also explains numerous selfless acts Bitcoin believers have performed to ensure Bitcoin network stayed robust and whole.

What is important, thus, is the weight of every individual believer and contributor. Looks like Bitcoin reward has been programmed to correlate with the time of joining and the contribution made by each member. The earlier you joined the concept, the higher rewards you could reap, dedicating way less efforts than every subsequent joiner.

Bitcoin system, in fact, is in no way different than traditional finance or VC investment. A VC that has put money into a pre-seed of a future unicorn would do way better than the one that put the same amount of money into an IPO.

In the same fashion, with each new boost in Bitcoin’s popularity, the mining of each individual block became harder and harder.

Bitcoin software mandated that the winner of each block would get 50 coins for the first 4 years, 25 coins for the next 4 years, and half as much in the following 4, – the concept known in BTC as halving. The halving is designed to stop once all 21 million coins are mined.

According to this logic, Bitcoin mining was possible with a simple PC for the first several years. Satoshi used his computer to mine 1.1 million, about 5 % of all Bitcoins, which are now worth billions, and which were, apparently, never spent, thus multiplying the mystery behind the altruistic figure of an anonymous creator.

2 years since Bitcoin inception, the community became large enough for innovation in mining equipment. Laszlo Hanecz, a Hungarian engineer, figured that if he used GPUs instead of less powerful CPUs, he could win Bitcoin mining contest much easier, and receive higher rewards. A migration from an ordinary central processing unit to a much more powerful graphics processing unit can be considered the first serious innovation in Bitcoin mining technique.

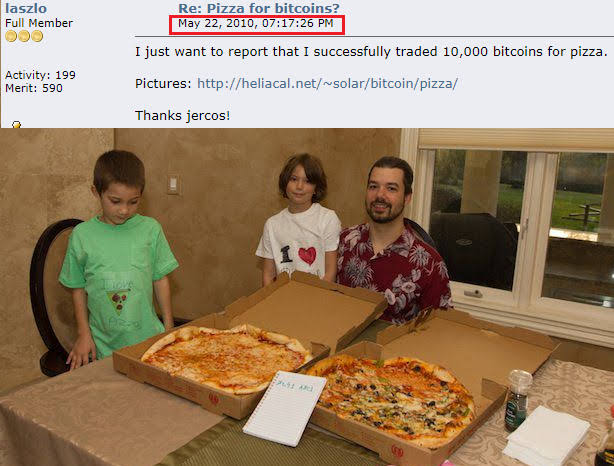

In May of 2010 Laszlo was winning 1400 coins daily. Worth noting that Satoshi was still around during that time and cautioned Laszlo against monopolising too much of the hashing power to avoid disincentivising the whole community. As mentioned before, early Bitcoin supporters were incredibly interested in the success of the project. Thus, to promote the usability of his newly mined Bitcoin, Laszlo has made the first ever purchase in Bitcoins, – a famous pizza purchase which is often quoted as the silliest spend of priceless coins. Laszlo paid about 10,000 Bitcoins for a Papa John’s pizza.

Don’t think we can rule out the possibility that this “silly” purchase was a major part of the reason why Bitcoin is considered such an important asset class today. Finally seeing the real life application of Bitcoin as a medium of exchange, Bitcoin community was jubilant. Martti Malmi, one of the first Bitcoin engineers and Satoshi’s pen friend, was jubilant:

“Congratulations, Laszlo, a great milestone reached”

About the same time Gavin Andersen, a Boston based programmer, who had earlier spent $50 for 10,000 Bitcoins, has launched a give-away campaign to give out 5 Bitcoins to anyone registering with the network.

Like most early Bitcoiners, Gavin was a libertarian, who saw Bitcoin’s main attraction in its decentralisation and open-source nature, where the evolution of the technology depended on all users.

Indeed, Bitcoin is quite like Internet, Wikipedia or Linux software, where each participant and contributor is intrinsically interested in the success of the enterprise

All the aforementioned individuals have dedicated a lot of time and effort to promote the idea and technology they had bought into: they have created forums in various languages to popularise the idea, brainstormed numerous applications of the technology (escrow transaction, bonded contracts, 3rd party arbitration, multi-party signature etc), code bug fixing,

Early on one of the developers in Bitcoin community has uncovered a bug that enabled a hacker to spend Bitcoins from another person’s wallet. The fact that this programmer had not exploited the discovered vulnerability but notified Satoshi and the community of it is indeed a huge testament to the selflessness and positive motivation of the early Bitcoin advocates. Since this programmer has been mining Bitcoin with GPUs himself, he realised that any vulnerability in the system could render all his coins useless. As all other developers, he was interested in the success of their open-source project.

About the same time Wikileaks scandal has happened. Even though the ideological foundation of libertarianism and decentralisation were similar and numerous members of the Bitcoin community urged for the support of Wikileaks, Satoshi has been defiant in his assessment. He believed that the interference with such highly controversial topic as Wikileaks could bring an unnecessary scrutiny and government attention to a still young cryptocurrency movement.

Satoshi’s last messages within Bitcoin forums correspond with the time of a serious deterioration of Hal Finney’s ALS (amyotrophic lateral sclerosis), which explain the theory behind Hal Finney being Satoshi Nakamoto, as well as the reason why no Bitcoins from Satoshi’s wallet had been ever spent. Moreover, Hal Finney has been the first person to ever receive Bitcoin software and Bitcoins from Satoshi. Of course, most inventors are the first people to try their own invention. Finney died in Phoenix, Arizona, on August 28, 2014, because of complications of ALS. Still, I would not call the search for Satoshi an aimless exercise.

In line with Transhumanist aspirations of the possible Bitcoin creator, Hal was cryopreserved by the Alcor Life Extension Foundation. Thus, it is entirely possible that he would be revived if cryopreservation turns out to be reversable and the medical solution to a now deadly ALS is discovered one day in the future.

First Exchange

In September 2010 Jed McCaleb has created the first ever Bitcoin exchange, Mt. Gox, where people could buy and sell their Bitcoins. This was the first time any person in the world could simply purchase a crypto coin without the need to get into technical details of Bitcoin mining. First Jed cooperated with PayPal to service his transactions. Once he realised the shortcomings of PayPal chargeback systems, he decided to team up with Mark Karpeles, French engineer who briefly worked with Linux, and later moved to Japan. Mark helped Jed set up the back end of Mt. Gox and worked with Martti Malmi to set up a European bank account to accept fiat for Bitcoin purchases on Mt. Gox.

Once the regulatory issues started piling up, Jed decided to hand over 88 % of Mt. Gox ownership to Mark Karpeles, to protect himself form any legal liabilities in case Mt. Gox ran into problems down the line. In retrospect, Jed has been a genius, who could be credited ith the invention of the first ever crypto exchange, who cannot be blamed for the biggest hack in history, which left thousands of Mt. Gox users bankrupt. During the time of the handover of this project, which Jef, probably considered a side hustle, the price of Bitcoin was $1. This was the time when 25 % of all of the world’s Bitcoins have already been released.

About the same time as Mt. Gox has been established, another important entrant joined the cryptoverse. In July of 2010 Ross Ulbricht has created Silk Road, which became known as an underground site where any person could purchase drugs with their Bitcoins. Despite a negative connotation and a less than glorious finale for Ross Ulbricht, Silk Road has become the first real life use case for cryptocurrency. The drugs marketplace gained its popularity through a similarly anonymous messaging platform, 4chan.

Roger Ver, an American entrepreneur, and a failed politician heard about Silk Road on Free Talk Live radio show, and immediately took notice of the new, libertarian technology. Roger already had unpleasant experiences with American government, when he was sentenced to 10 months in prison for what he believed was a political retaliation against his California campaign. In prison, Roger learnt Japanese and fled to Japan to start a new life as soon as his sentence was finished. By the time Roger learnt of Bitcoin and Silk Road, he has already amassed a fortune through his previous California business, and, getting a conviction, he started using his capital to buy up Bitcoins. In those early days, hundreds of thousands of dollars made such a difference that the price almost doubled, – from $1.89 to $3.30. In line with Bitcoin community incentivisation, Roger enabled Bitcoin payments in his business.

In general, Roger was the first person to take Bitcoin mainstream. He used Billboards, National radio, mainstream news coverage

Very soon thanks to Roger Ver marketing genius, one of the top libertarian institutions in American, George Mason, took note of Bitcoin. Equally, Forbes published a positive story on a “breakthrough technology”

The tide has turned. While dominated by gaming geeks and open source programmers, suddenly Bitcoin community became appealing to entrepreneurs and political ideologists.

In May 2011 Satoshi has written his final email before disappearing into ether. In this email he asked Martti Malmi to take full ownership of Bitcoin.org web site. By this time the price of Bitcoin was around $10, driven mainly by Silk Road, that has turned a concept of Bitcoin into a real currency.

Silk Road could be a perfect example to the phrase “Any publicity is good publicity”. After a largely negative piece on Gawker of June 1st, 2011, over a thousand new users registered on Silk Road, and the price of Bitcoin shot to $15.

Initial Bitcoin adaptors weren’t very happy with drugs-related publicity and tried to distance themselves from it. Jeff Garzik, one of the biggest contributors to Bitcoin code, has written to the police explaining that Bitcoin wasn’t as anonymous as most people thought, and claimed that it would be entirely possible to determine the owner of the assets through sophisticated network analysis, owning to the fact that all transactions have been recorded on the blockchain.

Despite Garzik’s attempts at reconciliation, US Senator Chuck Schumer decried the business of Silk Road in the news conference of June 5th 2011, and called for prosecutors to shut down the site. He described Bitcoin as an “online form of money laundering used to disguise the source of money”

Not surprisingly, the new surge of media attention and the recognition of Bitcoin anonymity brought another surge of interest from perspective buyers, sending the price of Bitcoin to $30, and bringing the number of Silk Road members to 10,000.

Bitcoin community was not ready for such attention. Ross Ulbricht has shut the Silk Road for some time, while Mark Karpeles found himself unable to process an increasing number of transactions.

This was the time when a benign nature of Bitcoin community has turned into an unpredictable chaos with new members of the foundation having less of an ideological interest in the success of the project, but more of the speculative attitude, greed and curiosity, which unavoidably comes when the movement goes mainstream.

The first major incident happened on Mt. Gox when the hackers exploited the vulnerability which allowed to create fake Bitcoins out of thin air and push the price down by selling those. On the morning of June 19, 2011, the price of Bitcoin on Mt. Gox plummeted from $17 to 1 penny in less than an hour. Hackers did that to be able to withdraw maximum number of Bitcoins, since Mt. Gox allowed the withdrawal of $1000 worth of Bitcoins a day only. The primitive design of the exchange and slow infrastructure ensured the hacker’s Bitcoins were still stranded on the withdrawal when the hack has been noticed. Nevertheless, other Mt. Gox users managed to buy around 260,000 Bitcoins at 99,94 % discount. What saved Mt. Gox that time was the fact that no transactions were recorded on the Blockchain until coins left the exchange. Thus, Mark was able to shut off the system, and reverse all the impacted trades.

Roger Ver came to Mt. Gox rescue when he offered his help in clearing up this mess. Roger realised that the survival of an early-stage technology in large part depended on the survival of the only Bitcoin exchange. Roger has also summoned his friend, fellow libertarian, Jesse Powell, who would later establish Kraken exchange, to the Mt. Gox rescue and dealing with hundreds of outraged customers, who managed to purchase Bitcoin at a bargain.

The day Mark reopened Mt. Gox the selling pressure and disbelief in the technology sent the price down. Forbes published the first out of many public obituaries for Bitcoin.

Further discrediting the technology of anonymity and decentralisation, the founder of a small Polish Bitcoin exchange Bitomat has accidentally deleted the files with all the private keys to his customers’ Bitcoin addresses, forever losing 17,000 Bitcoins. The strength of complete control each user had over their Bitcoins turned out to be a nightmare in case you lost your private key or a seed phrase. Whoever controls the seed phrase, – controls the wallet. If no one has the access to a Bitcoin wallet, unfortunately those Bitcoins are lost forever. Soon Bitomat’s screw up people realised that the integrity of the owners are as important as their professionalism. In July of 2011 the customers of another Bitcoin company, MyBitcoin, saw all their Bitcoins mysteriously withdrawn by the company’s owner, who has used a fake identity of Tom Williams. After these 2 savoury incidents, the price of Bitcoin fell to $6, about 80 % from the previous ATH.

While the declining price drove away opportunists and speculators, the early adapters grew ever more convinced in the importance of decentralisation, since both Bitomat and MyBitcoin disasters stemmed from the centralisation of Bitcoin ownership, entrusted to the individuals.

At around the same time Bitcoin some Silicon Valley employees started exploring Bitcoin and took fancy in the technology. Mike Hearn, Google employee, had created an email list for his colleagues, where he shared his thoughts on the new technology, where he praised the decentralisation and self-sustainability of the system. This is how top Silicon Valley talent joined the Bitcoin engineering project and started utilising the famous 20 % working time on non-Google experiments. Among various innovations, Googlers created BitcoinJ, a codebase that moved Bitcoin into mobile and thus facilitated the accessibility greatly.

In 2011 Bruce Wagner, The Bitcoin Show host, has organised a first ever Bitcoin conference, where people from all over the world came to put a face to the name on the screen, they used to previously interact with in their quest to create a perfect digital currency. The conference wasn’t huge, but it allowed connections and dialogue between Bitcoin enthusiasts that have previously did not know about each other’s existence.

That’s where Roger Ver met Erik Voorhees who believed that the only way governments can pay their debt and wards was from incessant money printing, and thus saw an untapped potential of scarce Bitcoin to solve the problem of inflation and unrestrained government control.

Unlike most libertarians, who believed that successful money should be backed by commodity that has an intrinsic value, Eric argued that it has been precisely the very virtual nature of Bitcoin that made it so valuable, due to its ability to be transferred much easier than gold, thanks to its divisibility and verifiability. Eric and Roger decided to work on converting libertarian doubters into the Bitcoin club. To do that they set off with donating their Bitcoins to the members of Free State Project. This lobbying has serendipitously coincided with Ron Paul’s Presidential campaign in which he likened the Fed’s money printing to a drug addiction. At the same time Occupy Wall Street movement took aim at the government’s decision to bail out the big banks but not the rest of the population. Soon enough Occupy Wall Street movement started accepting donations in Bitcoin.

In the wake of financial crisis and Iraq war, 2011, was the time when seemingly divergent ideological fractions converged on the importance of limiting government control.

Around this time political scientist Mark Lilla wrote that the principles of the sanctity of individual, the priority of freedom and the distrust of public authority has been enough to bring together “small government fundamentalists on the American right, anarchists on the European and Latin American left, democratization prophets, civil liberties absolutists, human rights crusaders, neoliberal growth evangelists, rogue hackers, gun fanatics, porn manufacturers, and Chicago school economists the world over”

Bitcoin became a part and a symbol of new American politics, which helped it win numerous new followers. Quite remarkably, however, in most cases where the users were losing money in crypto, because of a hack or an accident, these very users were turning to the government whose control they were trying to avoid with Bitcoin in the first place.

Moreover, the success of Bitcoin and Silk Road, which initially went hand in hand, was largely enabled by innovations, that came from the government. Internet itself was an outgrowth of several government research projects, while Tor network used by Silk Road, has been created by the Office of Naval Intelligence.

It wasn’t all that surprising that the government forces turned out to be smarter than the rebellious Bitcoin-empowered drug dealers from the dark web.

While Mt Gox was going through hacking turmoils NYC-based Syrian Jew Charlie Shrem has founded his own exchange, BitInstant, which would allow its customers to avoid going through cumbersome money wiring process of Mt Gox. Moreover, BitInstant aimed to fix the problem of slow bank payments in general. Worth noting that in 2012 banking system still has been using ACH, the technology from 1970s for bank transfers. Roger Ver immediately saw the potential and invested in BitInstant.

Charlie was a very entrepreneurial and smart guy. He figured he could not let the Silk Road opportunity to escape and got into a way of servicing the illegal marketplace through BitInstant.

At the same time new Bitcoin companies were being registered. BitPay was founded by 2 fraternity brothers from Georgia Tech Uni to facilitate online payments and reduce the commission from 2-3 % charged by traditional credit card companies to only 1 %.

Apart from being the co-founder of BitInstant, Eric Voorhees, has also established a gambling site, SatoshiDice, which enabled the users to do various small bets which would be otherwise impossible due to high processing fees in traditional finance.

BitInstant was quickly becoming the coolest kid on the block, with multiple influential people fighting for the right to put their investment. The major battle was going on between Wall Street Barry Silver & First Mark Capital and Another Syrian Jew David Azars, coming in with Winklevoss twins.

While the initial investors, like Roger Ver, advocated for picking Barry & an established VC Fund, Charlie couldn’t give up the ethnical connection to David and the celebrity status of the twins. He went with the latter. Winklevoss brothers did not limit themselves to one Bitcoin investment and started Winklevoss Capital fund, aimed at Bitcoin investments. Obviously, the Ukrainian developer creating the web site, has been paid in Bitcoins.

In October 2012 another entrepreneur took an interest in Bitcoin. Coming from Argentina, where rampant inflation left you with half the morning salary in the evening, Wences Casares immediately saw Bitcoin as an inflation hedge, and was looking into ways to get involved.

Before making any type of investment, Wences decided to check the strength of the protocol and paid over $250K to Eastern European developers to try and hack Bitcoin. Alas, Bitcoin protocol was unbreakable.

Wences was also the one who challenged the intrinsic value of gold as a reserve by saying that gold became valuable because it has been used as a store of value, and not the other way around. On this premise and having been persuaded by the strength and robustness of Bitcoin technology, Wences saw no reason why Bitcoin could not substitute gold as the world’s reserve. According to his logic, if Bitcoin became at least half as popular as gold the value of each Bitcoin would stand at $500,000.

Wences became one of the key ambassadors of Bitcoin in the world. Being a successful and well-respected inventor and entrepreneur, his opinion and network in Silicon Valley was paramount for the success of Bitcoin movement. He brought the president of PayPal, David Marcus, and the Director of Fortress Investment Group, Pete Briger, into the movement.

Wences was convinced on Bitcoin:

“It is the first time in 5,000 years that we have something better than gold. And it is significantly better. It’s much more secure, more divisible, more durable, and easier to transport. It is simply better”

Wences initial converts soon brought new important members into the movement, – Mike Novogratz from Fortress, Dick Costolo from Twitter, Reid Hoffman from Linkedin, Marc Andreessen, Chris Dixon and Andreessen Horowitz from a16 VC, Michael Ovitz from Disney, Charlie Songhurst from Microsoft. A conference organised by Wences and co-hosted by Allen & Co brought all these people together.

The day after the conference Business Insider published an article in which they stated that Bitcoin managed to unite fanatical conspiracy theorists, clear-eyed pragmatists, and diehard sceptics. Microsoft executive Soghurst published a paper where he predicted that Bitcoin will be soon one of top 6 world currencies, on par with US Dollar, Euro, Japanese Yen, British Pound & Chinese Yuan.

Bitcoin price jumped to $36.

2013 was the perfect time for Bitcoin to become the dear of the Silicon Valley crowd. A virtual currency that rose above national borders fitted perfectly with San Francisco’s great vision of changing the face of everyday life.

This was the time of the next technological jump in Bitcoin mining. The race for the Specialised Bitcoin mining ASIC chip that could crunch numbers hundreds of times faster than GPU has begun. At around the same time US based Chinese Yifu Guo and 3 Ukrainians, Oleksandr Lutskevych, Val Vavilov and Val Nebesny have created first in the world ASIC chips, which would double the Bitcoin hashrate in a month. ASICs were doing 66 billion hashes per second, compared to 2 billion GPUs were capable of.

Bitcoin arms race has begun with Silicon Valley investors rushing to invest into the top Bitcoin mining companies. Some of the most prominent of them were Balaji Srinivasan’s 21e6, which got serious backing from Marc Andreessen, Andreessen & Ben Horowitz, Peter Thiel and David Sacks; and Lutskevich’s Bitcoin mining pool ghash.io, which has briefly controlled over 51 % of bitcoin’s computing power in 2014.

Bitcoin exchange space has also seen some new entrants. Slovenian exchange Bitstamp had existed since 2011 and started to quickly pick up the pace in 2013, taking the share from less technologically adept and regulated Mt Gox. Coinbase and CEX.io were founded in 2013 as easy to use exchanges for retail customer base. While CEX.io was funded solely by Lutskevich ASIC-mined Bitcoins fortune, Coinbase attracted millions in VC investment.

As more and more people were discovering Bitcoin in 2013, the buying pressure pushed the price past $100, and culminated at over 300 on Mt Gox, where the surge of new accounts overwhelmed the servers and created the price lag, which eventually led to multiple orders’ cancellation, and the immediate sell off back to $100. April of 2013 can be counted as a major pump & dump scheme, however unintentional.

Wences famously announced that BTC price should be either zero or 5,000 times what it was that day, – back to the gold market cap comparison.

Price volatility wasn’t received very positively by Reuters financial columnist, Felix Salmon, who stated that Bitcoin’s price volatility made it nearly impossible for its use a s a currency.

Another important criticism of Bitcoin as a currency stated that the scarce nature of Bitcoin encouraged holding rather than spending of Bitcoins.

At that point of time, very similar to our days, the primary value of Bitcoin came from the expectation that it would be worth more in the future, allowing current holders to cash out for more than they paid.

Ross Ulbricht was arrested on October 2nd, 2013, charged with narcotics conspiracy, conspiracy to commit computer hacking, money laundering conspiracy, murder solicitation, each of which could lead to life sentence on its own. Funny enough, the way FBI managed to catch Ross had nothing to do with sophisticated technology, but rather with the diligent internet digging, which allowed them to discover an email address that was once used in a job description for Silk Road. Email was rossulbricht@gmail.com. Even though Ross has realised his mistake and deleted the email, someone on the forum has already responded to the ad, capturing Ross’ email on the servers for the eternity.

During its 2,5 years of operation, Silk Road has been used by thousands of drug dealers to distribute hundreds of kilograms of illegal drugs and launder hundreds of millions of dollars. Ross has been convicted by the jury on ALL accounts and given a life sentence. After Ross arrest Silk Road has been seized by FBI. Bitcoin price briefly fell to $100, allowing Winklevoss brothers to buy $1 mm worth of Bitcoin, immediately pushing the price back to $140. Ross Ulbricht’ Bitcoins were auctioned by Us Government, and Tim Draper was the lucky winner.

Free Ross DAO scam has been created shortly after to “raise money for Ross release campaign”

October 2013 was the time when Bitcoin started gaining popularity in a new, very important geography. Huang Xiaoyu and Yang Linke founded China’s first Bitcoin exchange, BTC China. Soon after they were joined by Bobby Lee, Stanford Alumni of Chinese origin, who offered his investment and English language expertise to take exchange global. Bobby became the face of BTC China, as well as their positioning strategist. He rightly realised that the appeal of American libertarianism would see little response from Chinese consumer. However, remembering the huge success of Q coin, digital money, launched in 2002, he saw the attractiveness of speculation and betting among Chinese population. Notably, Bobby’s brother, Charlie Lee, California based Google engineer, has created Litecoin.

Worth noting that China has been a very restrictive market, where people could not easily move money in and out of the country. Obviously, $50,000 per year limitation did not sit well with wealthy Chinese, who saw Bitcoin and crypto exchanges to expand their wealth and impact globally.

Bitcoin started swiftly taking over the market, with Tencent signing up with BTC China as a payment provider, and Baidu announcing it would start accepting Bitcoin. Very quickly China became the main driver of Bitcoin growth, both in terms of registered users and the price movement.

Bitcoin price shot up to $300 on Mt. Gox, while consistently hovering higher on the Chinese exchange. Bobby’s bet that Chinese would be going after the momentum proved right.

Huge popularity of Bitcoin in China, predictably, sounded an alarm among American regulatory and government circles, who were afraid to miss out to China on the new technology. US Government officials hurried to praise Bitcoin in multiple hearing that were later described by Washington Post as Bitcoin Lovefests.

On December 1st, 2013 the first ever research on Bitcoin from Wall Street was released where Gil Luria has praised Bitcoin as a foundation for “the new global crowd-funded open-source payment network”

All these praises raised public confidence and Bitcoin’s price to an extend which wasn’t tolerable by authoritarian Chinese government anymore. Chinese Communist Party had categories bitcoin as a digital commodity and banned any banks from processing transactions coming from Bitcoin. This has been the beginning of the end for BTC China. Tencent stopped all BTC China processing, in or out the exchange. Unable to withdraw their Bitcoins, Chinese users started selling it en masse, dropping the price 70 % worldwide. This was the time when a wittier Chinese exchange Huobi stepped up and managed to take all BTC China’s market share through indirectly averting government regulations.

Around this time a famous British sci fi writer Charlie Stross voiced a very important point related to Bitcoin’s potential and future, one nobody can really fight with:

“Bitcoin’s scarcity leads to vast inequality in the holdings of Bitcoin, to an extent that makes sub-Saharan African kleptocracy look like a socialist utopia”

Till now Bitcoin’s and all cryptocurrency’s fate and price largely depends on the people outlines in this article, so-called whales, that have accumulated most Bitcoin holdings early on. Chances are only about 10 people can regulate the price of Bitcoin, being a de facto Bitcoin price cartel.

To add to the inequality argument, already in 2014 large chunks of Bitcoin economy were owned by a few people who had been wealthy enough before Bitcoin came along. Equally, only people with access to super-powered computer chips and cheap energy could meaningfully take part in the mining of Bitcoin.

It is important to talk about the problems Bitcoin solves, however. Bitcoin network presents a significant improvement to the existing payment network, through security and low fees. Also, it gives unbanked people an opportunity to join the financial world, as well as send remittances cheaper. This application has been evaluated highly by Wall Street banks, all of which eventually opened Blockchain departments to create instant payments, which became a game changer for the banking industry. Equally, smart contracts, pioneered later by Ethereum, enabled an easy and convenient way of tracking transactions.

Early in Bitcoin days most of its proponents believed that the regulation of this asset would mean the end of Bitcoin. Jamie Dimon, JPMorgan Chase:

“Once Bitcoin companies have to follow the same rules as banks that will probably be the end of them”

And this is actually very true, when we look at crypto space in the light of today’s bear market. Pretty much all scammy and shady cryptocurrency projects have gone bankrupt or disappeared, having scammed all its customers, likes of FTX, Gro Protocol, Dino Swap, Adamant and many, many more – probably around 90 % of all crypto projects and marketplaces, if not more.

Nevertheless, those players that evolved together with the industry, and managed to adapt to the changing regulatory landscape and find the common footing with the governments, and ensure their customers’ protection, are still around.

Funny that Mt Gox hack of $400 million is almost the same in monetary value as the recent FTX fraud, – that is Mt Gox hack in Bitcoin is translated to about $14 billion in today’s money. FTX fraud is anywhere between $14 billion to $16 billion. History, however, says Mt Gox exchange has not been intentional, which I find very hard to believe in.

As story goes Mark Karpeles has been replenishing Mt Gox cold wallet for 3 years while it has been consistently emptied, without checking where the money has gone, and eventually realised that the whole exchange has been left without a single Bitcoin. Transferring Bitcoins to a hot wallet for 3 years thinking someone is simply selling them on your exchange without checking. “Someone has been stealing from the company by changing the transactions identifiers” – sounds very similar to $600 million hack by “someone” committed on FTX exchange after filing for bankruptcy.

By the time of Mt Gox fall there have existed the following exchanges:

Coinbase – Brian Armstrong

CEX.io – Alex Lutskevich

Kraken – Jesse Powell

BTC China – Bobby Lee

Huobi – Leon Li

OkCoin – Star Xu, invented margin trading

Mt Gox fall scared lots of players and made them stay away and disassociate themselves form the technology. Just like it is happening now, after a similar disaster with FTX, there have been the players who were looking into the core technology, and not the speculation element. Most major banks continued working on blockchain technology, such as Goldman Sachs (invested in Circle), Citibank, Santander, BBVA, UBS, Barclays & JPMorgan.

Being extremely interested in the technology, while sceptical of the Bitcoin mining Blockchain network, where over half of mining power was coming from the anonymous mining farms in China, these tradfi players were responsible for separating the concept of Blockchain from the concept of Bitcoin and starting using Blockchain technology independent of Bitcoin.

In an essay entitled “Blockchain: It Really Is a Big Deal” the head of research at IBM, Arvind Krishna, wrote that Blockchain technology was set to change any industry that required trust between two parties and had to rely on the middlemen. That’s how Blockchain got its name of a “trustless” system, – the one where trust is not needed, as it is embedded by design.

This is how, slowly, Bitcoin and Blockchain discussion started to revolve around the centres of power, – Wall Street and central bankers, – that it had been designed to circumvent back in 2008.

Equally, the initial members of the movement soon found themselves at trespass when their visions on the future of Bitcoin started diverging. This led to the split between the 3 core Bitcoin developers, leading Blockstream startup, and advocating for maintaining a limited number of transactions; and Gavin and Mike Heard, who wanted to upscale the possible number of transactions to have Bitcoin protocol compete with payment processing networks.

Later disagreements like those led to several hard forks in Bitcoin, which created various versions of the initial protocol, – Bitcoin, Bitcoin Cash, Bitcoin Gold, Bitcoin Unlimited, Segregated Witness, Bitcoin Satoshi Vision etc

Bitcoin remains a highly controversial and disputed asset with definitions ranging from “scam” and “Ponzi scheme” to the “new gold” and “biggest invention since Internet”.